Market share of washing machine

Japanese manufactures occupy domestic washing machine market!

- The sales of washing machine in the world is about 110 million units, it in Japan is about 4.9 million units.

- Haier Group has the top share of world's washing machine market.

- Hitachi has the top share of Japanese washing machine market.

The sales of home electronic appliances including AC(and heater), refrigerator, washing machine, microwave oven and vacuum cleaner for a year in the world is about 585 million units in 2017. That will increase about 600 units until 2022 according to the report of Fuji Keizai Co. in 2018.

The sales of washing machine in the world is about 110 million units among them of 2017. It was 3.4% increase from the previous year. A washing machine is sold well in China which accounts for 30% of washing machine market in the world because of a sales promotion campaign on National Day of the People's Republic of China and Single's Day(Guanggun Jie). A washing machine is also sold well in Vietnam and Philippins.

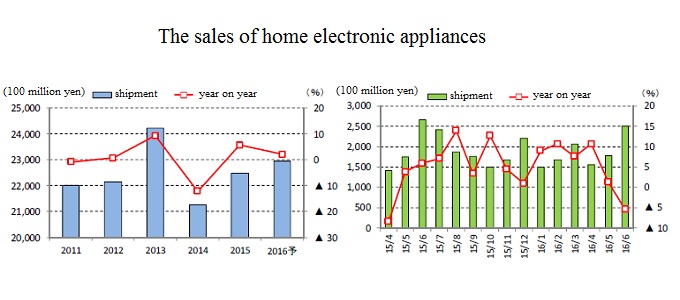

In Japan, the sales of washing machine is about 4.9 million units. It is 2% increase from the previous year. The demand of it shrinked from 2011 to 2015 because of Eco-point system. Ecopoint system was introdeuced from 2009 to 2011, and many people bought home electronic appliances to get Eco-point. People can exchange Eco-point for various coupons and prepaid cards. However, the demand of washing machine is recoverying from 2016 since people who buy it from 2011 to 2015 replaced it.

By type of washing machine form, vertical type washing machine is very popular in Japan. It accounts for 85% of the total sales of it in Japan. In addition, large capacity washing machine is also very popular in Japan since the number of DINKS and single person is increasing. They want to wash all own laundry at once in the weekend. Average purchase price of it is 63 thousand yen, and is higher in recent years because of large capacity washing machine.

In the world's washing machine market, Haier Group has the top share of this market. It has the top share because of not only in China but also expanding overseas by M&A. It bought the consumer electronics division of SANYO Electric Co. which was Japanese major electronics company. It also bought the consumer electronics division of GE in 2016. Whirlpool Co. in the USA has the second share of this market. It is proactive in expanding China and India.

In the Japanese washing machine market, Hitachi has the top share of this market. Panasonic, Toshiba and Sharp have a certain volume of market share. On the other hand, Haier and Whirpool do not have large market share. The reason may be that Japanese like a large capacity washing machine with multifunction in spite of high price.

Japanese washing machine market reached maturity because ownership rate of it in Japan is over 95% now. However, Japanese home appliance manufacturers sell various washing machine with adapting it to Japanese lifestyle. For example, Sharp sells a washing machine which has partial washing devise, Hitachi sells a washing machine which can find stain and adjust washing operation automatically. Panasonic sells a washing machine which have detergent automatic putting function and communication function by smartphone.

Hitachi(TYO:6501), Panasonic(TYO:6752), Toshiba(TYO:6502) and Sharp(TYO:6753) are listed on the Tokyo Stock Exchange. Foreign investors can invest in them on NYSE by ADR(American Depositary Receipt). In addition, they can invest these companies through many ETFs, iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more. Many Japanese companies increase their sales and profit with weak yen. If investors want to hedge an impact of fluctuations in foregn exchange rates, they should invest currency hedged ETFs, Deutsche X-trackers MSCI Japan Currency-Hedged Equity Fund(DBJP) and iShares Currency Hedged MSCI Japan ETF(HEWJ).

Cement Market

Cement Market Department Market

Department Market Gyudon Market

Gyudon Market Frozenfood Market

Frozenfood Market