Market share of glass

Glass market is an oligopolistic market, but!?

- The market size of glass industry in the world is about 3.1 trillion yen(about 31 billion dollars).

- Asahi Glass Co. has the top share of this market.

- Japanese glass manufacturers are proactive in developing a new glass.

The market size of glass industry in the world is about 3.1 trillion yen(about 31 billion dollars) according to the total sales of 12 glass manufacturers. Glasses for building or house accounts for about 80% of the glass market. It is said that glass market is an oligopolistic market because of high entry barriers. A new glass manufacturer need to buy large glass manufacturing eqipment and to bring fragile glasses.

The glass demand for building, houses, automobile and thin flat screen TV pulled glass market growing until 2007. This market shrinked by the financial crisis of 2007-2008. Most glass manufacturers results deteriorated because of recession. They was recovering from since 2013 depending on the glass demand for not only house and building but also smarphone. However, the price of glass for smartphone is declining with the rise of Chinese glass companies.

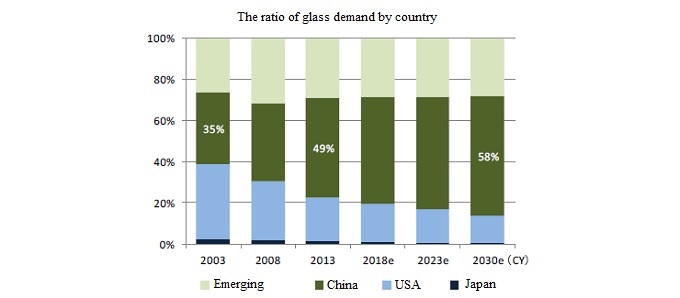

The pace of glass market growth in developed countries is slow though the world's glass market will grow in the future. Emerging countries, especially China, have a key to grow the glass market. Indeed, the glass demand of China account for about 50% of the global glass demand. It is said China will account for about 60%.

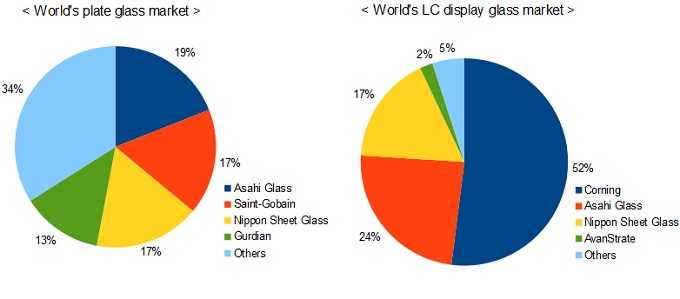

About the market share of plate glass, Asahi Glass Co. has the top share of this market. Saint-Gobain S.A has the second share, Nippon Sheet Glass Company has the third share of this market. On the other hand, Corning Inc. has the top share of the LC display glass market. Asahi has the second share, Nippon Electric Glass Company has the third share of this market.

Asahi Glass Co. was founded in 1907 to make plate glass domestically by Toshiya Iwasaki who was the second president of the Mitsubishi Zaibatsu (financial and industrial conglomerate). Asahi Glass Co. is doing a variety of business developments, glass, chemicals and ceramics. Its sales in 2017 is about 1.5 trillion yen(about 15 billion dollars). Its operating profit of LC glass dropped to 60% compared with that in its best period because the demand of LC glass decreased. Therefore, it is proactive in developing new glasses, UV cut glass, glass for museum, touch panel glass and more.

Nippon Sheet Glass Co. was founded in 1918 to make plate glass by Yosaburou Sugita. Its sales in 2017 is about 60 billion yen(about six billion dollars). Its new glass named "Super Spacia" was recognized with Agency for Natural Resources and Energy Prize in 2018. Super Spacia has both thinness and heat insulation.

Nippon Electric Glass Co. was founded in 1944, and span off to be independent from NEC in 1949. It extended its business to glass for TV (picture) tube in 1965, and became one of the world's major glass manufacturers. Its sales in 2017 is about 30 billion yen(about three billion dollars). Its new glass "Invisible Glass (Ultra-Low Reflection Glass)" was a tipic in glass industry.

Japanese glass manufacturers have already expanded overseas, but they have not played a prominent role in China. It is said that they cannot keep the current share except China market. They should acqire the share of China market though Chinese manufacturers is overstocked with its glasses. They should also expand other emerging countries. However, it is difficult for them to do that because emerging country's politics and economy are unstable. Nippon Sheet Glass Co. decreased its factories in Brazil, Asahi Glass Co. restructured its factories in Russia.

Asahi Glass(TYO:5201), Nippon Sheet Glass(TYO:5202) and Nippon Electric Glass(TYO:5214) are listed on the Tokyo Stock Exchange. Foreign investors can invest in Asahi Glass on NYSE by ADR(American Depositary Receipt). They can invest above companies through many ETFs, iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more. Many Japanese companies increase their sales and profit with weak yen. If investors want to hedge an impact of fluctuations in foregn exchange rates, they should invest currency hedged ETFs, Deutsche X-trackers MSCI Japan Currency-Hedged Equity Fund(DBJP) and iShares Currency Hedged MSCI Japan ETF(HEWJ).

Cement Market

Cement Market Department Market

Department Market Gyudon Market

Gyudon Market Frozenfood Market

Frozenfood Market