Market share of frozen food

Frozen food market was about 30% increase as compared with 2000!

- The market size of frozen food in the world is about 130 billion dollars, it in Japan is about 7 billion dollars.

- Especailly the sales of frozen Okonomiyaki is increasing in recent years.

- Maruha Nichiro Corporation has the top share of this market.

People all over the world are getting more concerned about frozen food because not only microoven spread but also frozen food keeps nutrients without preservative or artificial preservative. In addition, the advancing technology improved the flavor of it.

The market size of frozen food in the world is about 130 billion dollars. That was about 30% increase as compared with 2000 according to the report of Euro monitor and IMF. It is said that this market in emerging companies will increase more and more. Because the per capita consumption of frozen in developed countries for a year is 90 dollars, that in emerging countries is 10 dollars. The difference between the former and the latter is nine times. That was larger than the difference of their per capita GDP five times.

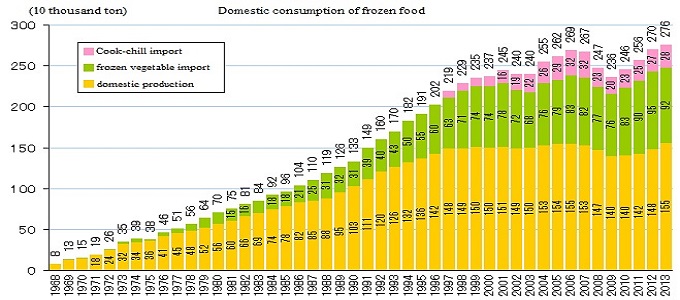

In Japan, the market size of frozen food in 2017 was about 700 billion yen(about 7 billion dollars) according to the report of Japan Frozen Food Association. The industrial use of it was about 420 billion yen, the home use of it was 280 billion yen. Cook-chill foods increased steadily, but frozen vegetables decreased slightly because of rising its price by unseasonabe weather.

Especailly the sales of Okonomiyaki among the frozen foods is increasing in recent years. Okonomiyaki is a Japanese pancake fried on a hot plate with bits of meat, vegetables and seafood. The market of frozen Okonomiyaki is about 14 billion yen, it increased 5.2% from the previous year. It was well sold in not only grocery store but also convenience store. It is said this market will grow 170 billion yen until 2022.

The sales of frozen rice dish is also increasing in recent years. The market size of it is about 260 billion yen in 2017, that was 3.1% increase from the previous year. This market shrinked from 2013 to 2014, but Japanese companies sold new frozen fried rice to increase the sales of it from 2015. In addition, the sales of frozen roasted riceball also increase this year. It is said this market will grow 280 billion yen until 2022.

The sales of frozen noodle increased first time in four years. Frozen frozen pasta and Udon which is a Japanese thick wheat noodle sold well because of renewal. Especially, Nissin's frozen pasta brand "THE PASTA" is gaining popularity. The market of frozen noodle is about 600 billion yen, it will grow 650 billion yen until 2022.

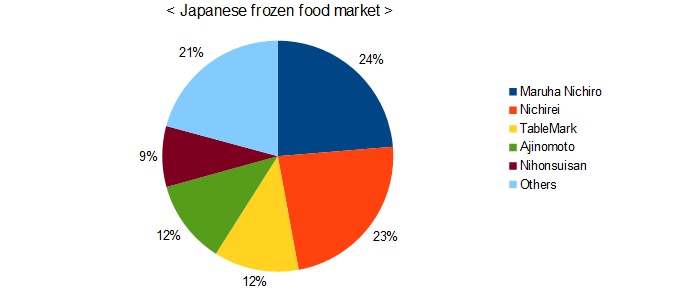

About the market share of frozen food in Japan, Maruha Nichiro Corporation has the top share of this market. NICHIREI CORPORATION has the second share, TableMark Corporation which is a subsidiary of JT has the third share of this market. The sales of Maruha Nichiro is about 900 billion yen. Its top seller is a canned food, but its frozen rice dish and frozen noodle are also very popular, Yokohama Ankake Ramen, Chahan-no-Kiwami and more.

NICHIREI has the large share of not only frozen food but also refrigerating warehouse. It also operates cold storage distribution business in the overseas. Its sales is about 560 billion yen, and is increasing slightly year by year. Its top sellers are frozen fried chiken, hamburg and rice dish. Its frozen sweets are popular in Japan.

By the way, Japanse frozen food companies are proactive in expaning ASEAN member countries in recent years. They think this market will grow with increasing the numbr of convenience stores and microwave oven. Ownership rate of microwave oven in Singapore is alreday 69%, but it in Malysia and Thailand is only 10%. Japanese frozen food companies will boost their sales and profit by expanding ASEAN countries.

Maruha Nichiro(TYO:1333), NICHIREI(TYO:2871) and JT(TYO:2914) are listed on the Tokyo Stock Exchange. Foreign investors can invest in JT on NYSE by ADR(American Depositary Receipt). They can invest above companies through many ETFs, iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more. Many Japanese companies increase their sales and profit with weak yen. If investors want to hedge an impact of fluctuations in foregn exchange rates, they should invest currency hedged ETFs, Deutsche X-trackers MSCI Japan Currency-Hedged Equity Fund(DBJP) and iShares Currency Hedged MSCI Japan ETF(HEWJ).

Cement Market

Cement Market Department Market

Department Market Gyudon Market

Gyudon Market Frozenfood Market

Frozenfood Market