Market share of refrigerator

Japanese refrigerator market reached maturity but!?

- The world's sales of refrigerator was about 126 million units, Japanese sales of it is about 4.3 million units.

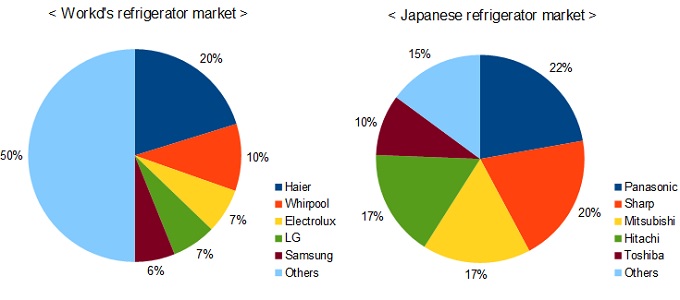

- Haier Group has the top share of the world's refrigerator market.

- Panasonic has the top share of the Japanese refrigerator market.

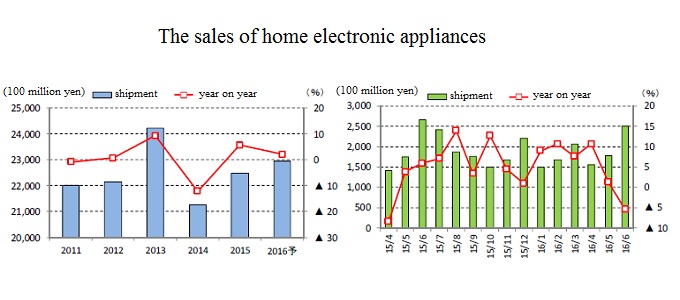

The sales of home electronic appliances including AC(and heater), refrigerator, washing machine, microwave oven and vacuum cleaner for a year in the world is about 585 million units in 2017. That will increase about 600 units until 2022 according to the report of Fuji Keizai Co. in 2018.

The world's sales of refrigerator in 2017 was about 126 million units, it was 0.4% increase from the previous year. A refrigerator was sold well in Europe, Japan, USA, and especially India. It is sold well in India because of infrastructure development by Prime Minister of India Narendra Modi. India in 2017 has climbed up to twenty sixth position in World Bank's electricity accessibility ranking from 99th spot in 2014.

On the other hand, the Chinese sales of it in 2017 grew sluggishly. The number of new housing strats was gloomy because Chinese government regislated real-estate investment. In addition, the sales of it in Southeast Asia also grew sluggishly because of unseasonable weather.

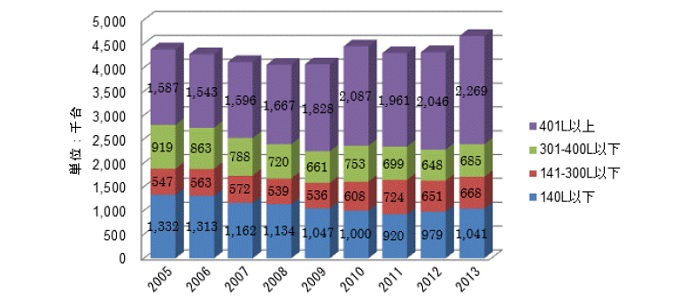

In Japan, the sales of refrigerator in 2017 is about 4.3 million units. It is 1% increase from previous year, that is the first increase in four years. By type of refrigerator capacity, small capacity one(under 200L) accounts for 38%, medium capacity one(from 201L to 400L) accounts for 22%, and large capacity one(over 401L) accounts for 40% of the total sales of it. Average purchase price of it is 88 thousand yen, and is higher in recent years because of large capacity and multifunction.

In the world's refrigerator market, Haier Group has the top share of this market. It has the top share because of not only acqiring market share in China but also expanding overseas by M&A. It bought the consumer electronics division of SANYO Electric Co. and of GE. Whirlpool Co. in the USA and Electrolux in Sweden have a certain volume of market share of it.

In the Japanese refrigerator market, Panasonic has the top share of this market. Sharp has the second share, Mitsubishi Electric has the third share, Hitachi has the fourth share of this market. On the other hand, Haier and Whirpool do not have large market share. The reason may be that Japanese like a multifunction refrigerator in spite of high price.

Japanese refrigerator market reached maturity because ownership rate of it is near 100% now. However, Japanese home appliance makers develop a new refrigerator to increase their sales. For example, Panasonic sells a refrigerator which have partial freezing function. This function also called seven days partial can keep the fressness of fish and seafood without deep-freeze for seven days. Sharp sells a refrigerator which have hot storage, Hitachi sells a refrigerator which have vacuum storage.

Panasonic(TYO:6752), Hitachi(TYO:6501), Mitsubishi Electric(TYO:6503) and Sharp(TYO:6753) are listed on the Tokyo Stock Exchange. Foreign investors can invest in them on NYSE by ADR(American Depositary Receipt). In addition, they can invest these companies through many ETFs, iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more. Many Japanese companies increase their sales and profit with weak yen. If investors want to hedge an impact of fluctuations in foregn exchange rates, they should invest currency hedged ETFs, Deutsche X-trackers MSCI Japan Currency-Hedged Equity Fund(DBJP) and iShares Currency Hedged MSCI Japan ETF(HEWJ).

Cement Market

Cement Market Department Market

Department Market Gyudon Market

Gyudon Market Frozenfood Market

Frozenfood Market