Market share of cement

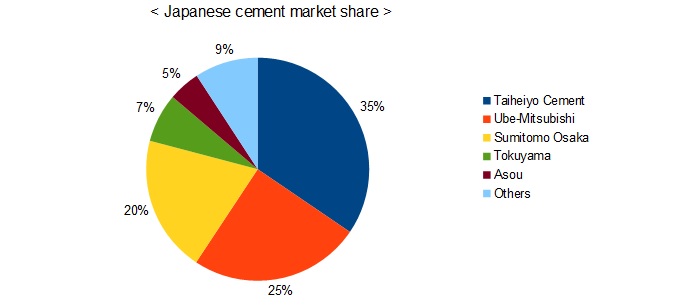

Five companies account for 90% of domestic cenment market!

- The market size of cement industry in Japan is about one trillion yen.

- Taiheiyo Cement has the top share of domestic cement market.

- Many cement companies work to reduce carbon dioxide emissions.

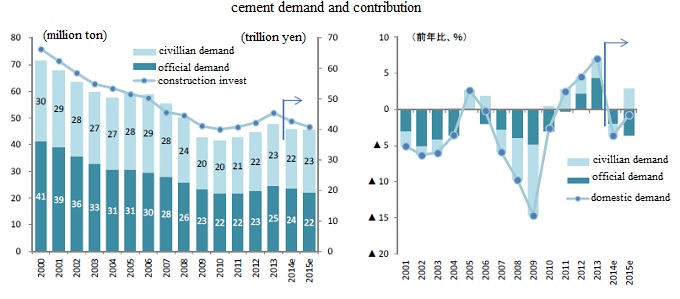

The market size of cement industry in Japan is about one trillion yen(about one billion dollars) according to the total sales of five sement companies. The domestic demand for cement is about 42 million tons according to the report of Japan Cement Association. The domestic demand is shrinking slightly year by year, and reached the second lowest level from 1990. Japanese cement companies increase export volume of cement because of shrinking domestic demand of cement.

The domestic demand of cement was at the record high level in 1990. Japan enjoyed booming economy called the asset price bubble economy then. It was shriking after 1990, it decrease rapidly especially after implementation of the amended Building Standards Law in 2007, global financial crisis in 2008 and cut the public works projects in 2010.

In recent years, the domestic demand of cement increased from 2011 to 2015 because of recovery and reconstruction demand for 2011 Tōhoku earthquake and tsunami. That has peaked out after 2016, and the domestic demand of cement was decreasing. In additon, the number of constructing reinforced-concrete (RC) structure in 2017 decreased from the previous year since a labor cost is rising.

The domestic demand of cement decreased for three years in a row, and dropped to almost half of its peak. The quantity of cement production also decreased from 1996, and dropped to almost 60% of its peak. They will increase temporarily because of Tokyo Olympic and redevelopment of ruban area. However, they will start to decrease again after that.

Therefore, there was progress in the restructuring of the cement industry from 1990s. The five cement companies account for 90% of domestic cenment market as a result. Only three compnaies, Taiheiyo Cement Corporation, Ube-Mitsubishi Cement Corporation and Sumitomo Osaka Cement Company, account for about 80% of this market.

Taiheiyo Cement has the top share of domestic cement market, account for 35% of this market. Chichibu-Onoda Cement and Nihon Cement were merged to form it. Its sales of 2018 is about 900 billion yen. It is doing a variety of business developments, not only cement but also natural resources, construction, real-estate, enjineering, information processing and more. It is proactive in expanding other industry.

By the way, many cement companies work to reduce carbon dioxide emissions. The cement industry accunts for 4% of the total carbon dioxide emissions in Japan. Cement companies exhasut when they make and binrg cement. They are proactive in energy saving activity with various ideas.

Taiheiyo Cement(TYO:5233) and Sumitomo Osaka Cement(TYO:5232) are listed on the Tokyo Stock Exchange. Foreign investors can invest in Taiheiyo Cement on NYSE by ADR(American Depositary Receipt). They can invest above companies through many ETFs, iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more. Many Japanese companies increase their sales and profit with weak yen. If investors want to hedge an impact of fluctuations in foregn exchange rates, they should invest currency hedged ETFs, Deutsche X-trackers MSCI Japan Currency-Hedged Equity Fund(DBJP) and iShares Currency Hedged MSCI Japan ETF(HEWJ).

Cement Market

Cement Market Department Market

Department Market Gyudon Market

Gyudon Market Frozenfood Market

Frozenfood Market