Market share of cosmetics

Japanese cosmetics market grows recent years!

- The market of cosmetics grow not only economic recovery but also foreign visitors.

- Shiseido has the top market share, and is proactive in expanding overseas.

- There are many small sized and start-up cosmetic companies in Japan.

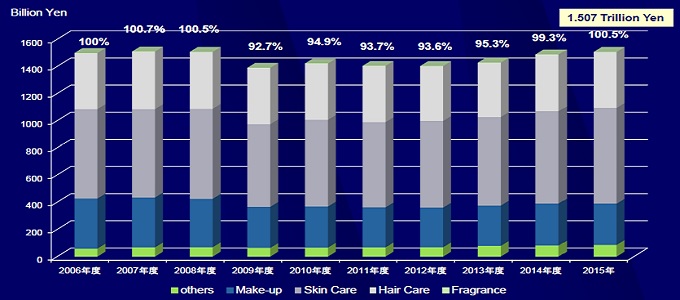

The market size of toiletries in Japan is about 2.5 trillion yen(25 billion dollars), and the market size of cosmetics among toiletries in 2016 is 1.5 trillion yen according to the report of Ministry of Economy, Trade and Industry.

The market of cosmetics grow not only economic recovery but also foreign visitors after cosmetics became duty-free goods in 2014.In addition, cosmetic companies succeed to stimulate demand in a skin-care category. Especially, a skin lotion for wrinkle amelioration is very popular now.

A cushion foundation(cushion compact) which is facial cosmetics continue to be hot. It is a new type of liquid foundation, it provide a smooth undectable finish for make-up. Concealers which is used to mask dark circles and age spots are also popular. The demand of highlight which is used to draw attention to the high points of the face is increasing year by year. Make-up trend which focussed on a mouth continues in a point make-up. A lip tint which is more lightly than lipstick and more colorful than gloss rise in popularity now.

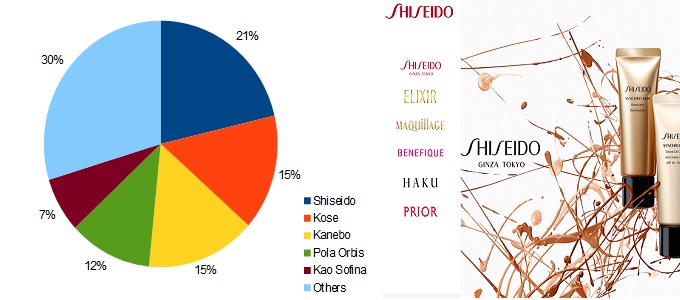

About the cosmetic market share in Japan, Shiseido has the top market share. It accounts for 21% of this market. Shiseido has not only Shiseido brand which is worldwide brand but also bareMinerals, Clé de Peau Beauté, laura mercier, NARS and more. Shiseido bought bareMinerals(Bare Escentuals Inc) in 2010 and laura mercier(Gurwitch Products, LLC) in 2016. It is well known that Shiseido is proactive in expanding overseas through M&A.

KOSÉ Corporation has the second market share. Its DECORTÉ(Cosme decorte) brand is popular in Japan and China. The sales of Sekkisei and ESPRIQUE increase in recent years. Sekkisei is a skin-care brand for beautiful skin, it is well known for using Yui Aragaki for the CM of this product. ESPRIQUE is a make-up brand for all seasons, it is well known for using Keiko Kitagawa for the CM. KOSÉ advanced into Brazil market and sell products of SKNY(Stephen Knoll New York). Kanebo has the third market share, Pola Orbis has the fourth market share.

By the way, there are many small sized and start-up cosmetic companies in Japan. They account for 50% of this market. They sell unique skin-care product by own online shops. Especially, face sheet mask, all-in-one gel are rising popularity. On the other hand, department stores sell cosmetics through various services, such as skin-care advice, facial massage and make-up service. Many people buy exclusive cosmetics and hair care products in department stores.

Shiseido, KOSÉ and Pola Orbis are listed on the Tokyo Stock Exchange. Foreign investors can invest in Shiseido on NYSE by ADR(American Depositary Receipt). In addition, they can do them through many ETFs, MAXIS Nikkei 225 ETF(NKY), iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more.

Beer Market

Beer Market Medicine Market

Medicine Market CS Market

CS Market Noodle Market

Noodle Market