Market share of Alcoholic-drink

The big 4 occupy alcoholic drink market of Japan!

- The market size shrinked, but sales of whisky and RTD(Alcopop) increased.

- The big four companies occupy this market.

- The export of alcoholic reaches a record high for the five years in a row.

The market size of alcoholic drink in Japan is about 3.57 trillion yen(35 billion dollars) according to the report of National Tax Administration Agency. This market is shrinking little by little every year because it of 2015 is 3.59 trillion yen. The consumption amount of alcoholic drink also fell to about half of that in its prime. The number of people who drink in a bar or restaurant was decresing during the years. On the other hand , the number of people who drink in a house was incresing.

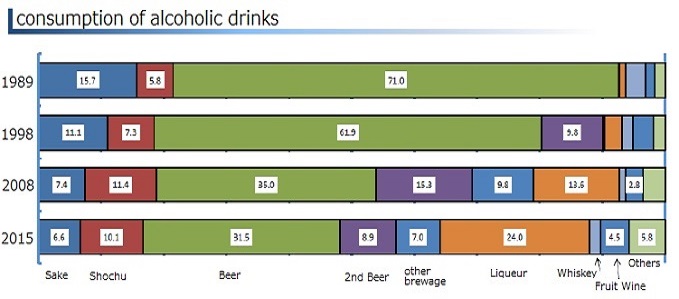

According to the consumption amount of types of alcoholic drinks, a beer is the most popular alcoholic drink in Japan. However, the ratio of beer is decreasing every year. The ratio of liqueur and wine are increasing instead of beer. It is said many young people don't like a bitter taste of beer.

The ratio of Shochu which is a Japanese distilled liquor increased by Imo Shochu boom from 2000 to 2005, but it remains flat now. Shochu is distilled from rice, barley, sweet potato, buckwheat or brown sugar. Imo Shochu is distilled from sweet potato. The ratio of whisky increased from 2000 to now by highball boom. A highball is made with Scotch malt whiskey and club soda. HotLand corporation opend a highball bar called Highball-Sakaba several years ago.

The big four companies(Suntory, Sapporo, Kirin and Asahi) occupy the Japanese alcoholic market. The sales of Suntory is biggest among them, but Suntory does not occupy the top share of all type of alcoholic drinks. The share of beer, wine and whiskey is below.

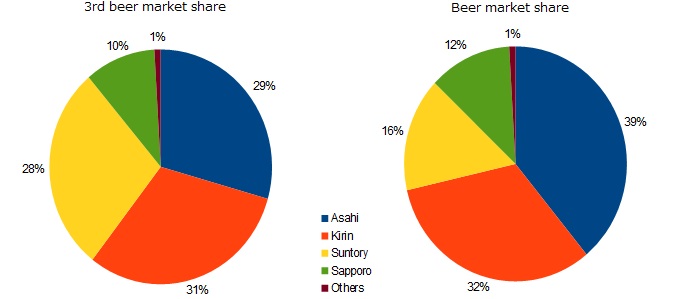

Before the beer share, you should know that there are the three types beers which consist normal beer, Low-malt beer and the third beer in Japan. The amount of liquor tax of Japan increases by the amount of malt, so beer companies make Low-malt beer called Happoshu to keep down the tax and sell it cheaper than normal beer. As a result, Japanese government raised liquor tax for Low-malt beer because of fearing decreasing amount of liquor tax.

Beer companies made the third beer in response to rising liquor tax. The third beer has a taste similar to beer without malt. It belong a liqueur in Japanese tax law because it do not have a malt, so the third beer is lower price than Low-malt beer. It contribute increasing the above ratio of liqueur consumption. Nowadays, some of Japanese like a beer since it is flavorful, and the others like the third beer since it is the cheapest beer. However, the market of the third beer will shrink year by year because Japanese government unify liquor tax in 2026. Normal beer is reduced taxation, Low-malt beer and the third beer is increased taxation by this unifying.

In the normal beer market, Asahi Breweries Ltd. has the top market share. Asahi's top-seller beer is "Super Dry" which is sold from 1987. Super Dry gained the top sales of beer in 1996, and it has the top share even now. Kirin Brewery Company accounts for the second share of normal beer. Kirin's top-seller is "Ichiban-Shibori" which is made by primary wort. Suntory Liquors Ltd. accounts for the third share, its top-seller is "Premiun Malt's". Sapporo Breweries Limited accounts for the fourth share, its top-sellers are "Kuro-Label" and "Ebisu".

These beers except Ebisu beer are sold not only Asia but also USA and Europe. Asahi and Kirin are top 10 beer companies in beer sales world ranking.However, these beer companies are not nearly as big as Anheuser-Busch InBev is. Japanese beer companies plan to do M&A and develop new craft beer because it is in vogue in the world.

In the third beer market, Kirin has the top market share. The third beer of Kirin is "Nodogoshi-Nama" which means going down well like a normal beer in Japanese. The sales of it is the top sales among the third beers 11 years in a row from 2005. The second is Asahi's "Clear Asahi", the third is Suntory's "Kinmugi", the fourth is Sapporo's "Mugi-to-hop". Many Japanese take a interest in these beers after unifying liquor tax in 2026.

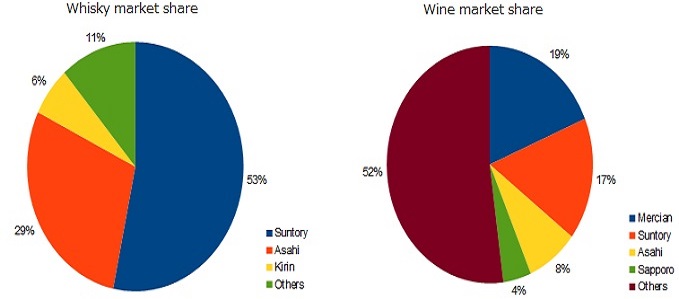

In the wine market, Mercian which is a subsidairy of Kirin has the top market share. The second is Suntory, the third is Asahi, the fourth is Sapporo. These four company occupy the half of wine market, the other companies occuly the half of this market. The big four companies do not completely occupy the wine market.

On the other hand, Suntory and Asahi account for about 80% of the whisky market. Suntory sells not only "Yamazaki" and "Hibiki" but also "Jim Beam". Suntory bought Jim Beam in 2014. In addition, RTD(Alcopop) is popular in Japan, "Horoyoi" made by Suntory and "Hyoketsu" made by Kirin are very popular.

By the way, the export of alcoholic drinks from Japan increase year by year. The exports value of it is about 43 billion yen, and reaches a record high for the five years in a row. Especailly, the export value of Sake which is a Japanese rice wine became double compared to it in 2006. The export of whiskey became tenfold comapred to it in 2006.

Asahi, Kirin, Sapporo and Suntory are listed on the Tokyo Stock Exchange. Foreign investors can invest in Kirin and Suntory on NYSE by ADR(American Depositary Receipt). In addition, they can do it through many ETFs, MAXIS Nikkei 225 ETF(NKY), iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more.

Beer Market

Beer Market Medicine Market

Medicine Market CS Market

CS Market Noodle Market

Noodle Market