Market share of security service

Security companies aiming for new business associated with security!

- The market size of security service in Japan is about 3.4 trillion yen.

- SECOM Co has the top share of security market in Japan.

- Japanese security companies strengthen security service by IT because of high profit margin.

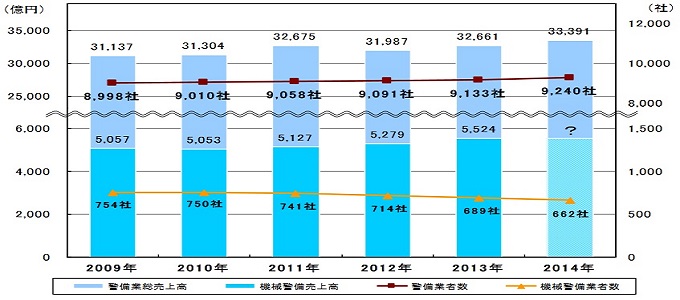

The market size of security service in Japan is about 3.4 trillion yen(about 34 billion dollars) in 2016 according to the report of All Japan Security Service Association. This market increased from 1990s with growing awareness of security. However, the trend of this market peaked in 2007, its growth reached a plateau along with the recession and price war.

Many security companies were born in 1960s, SECOM Co in 1962, Sohgo Security Services Co in 1965 and CENTRAL SECURITY PATROLS Co in 1966. Many Japanese companies were conscious of importance of security after the 300 million yen robbery and companies bombing incidents. Many companies thought that water and security werer free in Japan before these incidents.

Security companies started a home security service for citizens in 1980s. Though rich people use it at first, the elderly and woman who lives alone use it now. In addition, security companies offer various services, such as transporting cash fot ATMs, traffic control for events and security on disaster.

About the share of security market, SECOM Co has the top share and is largest security company in Japan. Sohgo Security Services Co has the second share, CENTRAL SECURITY PATROLS Co(CSP) has the thrid share. There are many small and medium‐sized security companies except these three companies.

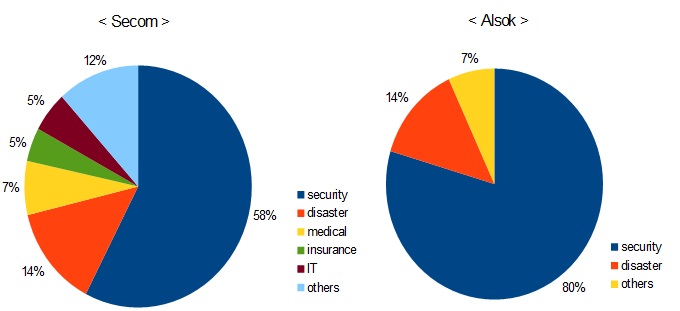

Secom earned 40% of its sales except security servise in 2017 though it is a security company. It is aiming for new business associated with security, aging society and disaster with big data. It bought Nohmi Bosai Co which is the largest disaster preventing facility manufacturer in Japan. It also bought Pasco Co which is major IT company about GIS(Geographic Information System). In addition, it advanced into general insurance industry in 1998 through buying Toyo Kasai Co whose name is Secom General Insurance Co now.

On the other hand, Sohgo Security Services Co whose brand is "ALSOK" earns about 80% of its sales by security servise in 2017. Many banks request ALSOK to do cash transportation of ATMs. Sohgo Security Services Co is also proactive in M&A, but it focus on buying security companies. It bought Hitachi Security Service in 2017.

Secom and ALSOK strengthen security service by IT. They use not only ordinary security camera and sensor but also wearable camera and watch. In addition, security from sky is stepped up by drone, balloon and airship. A man must go a scene of the incidents when the machines look incidents by law. However, security with IT machine makes high profit margin.

By the way, Japanese security companies put work into overseas development. Secom already expand overseas, China, South Korea, Taiwan and Thailand. ALSOK also expnad overseas, China, Thailand, Malaysia and Indonesia. They seek for expanding Asia.

Secom, ALSOK and CSP are listed on the Tokyo Stock Exchange. Foreign investors can invest in Secom on NYSE by ADR(American Depositary Receipt). In addition, they can do them through many ETFs, MAXIS Nikkei 225 ETF(NKY), iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more.

Construction Market

Construction Market Telecommunications Market

Telecommunications Market Automobile Market

Automobile Market Real-estate Market

Real-estate Market