Market share of general insurance

This market increases for five years in a row from 2011!

- Japanese general insurancemarket increases for five years in a row.

- The three general insurance companies account for about 90% of domestic market.

- Japanese general insurance compnaies accelerate expanding overseas.

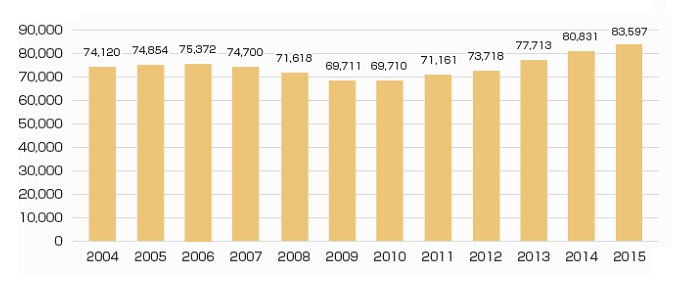

The market size of general insurance(property and casualty insurance) in Japan is about eight trillion yen(about 80 billion dollars) in 2016 according to the report of General Insurance Association of Japan. This market size ranks third in the world, after USA and China. This market decreased from 2006 to 2010, but it increases for five years in a row from 2011.

The amount of automobile insurance and fire insurance fee increases because of revising an insurance premium rate. In addition, new general insurances also increases, such as construction insurance, machine insurance, Employer's Liability insurance. New general insurances are released with risk of new industries.

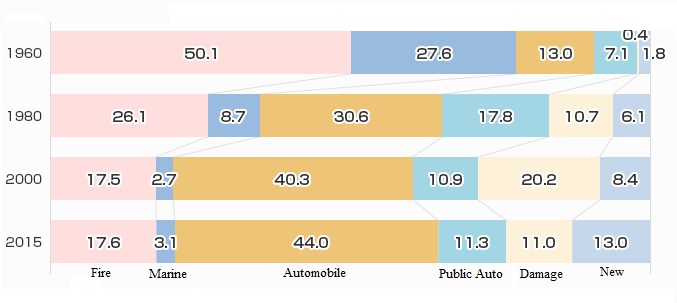

The amount of automobile insurance fee which account for 60% of the general insurance market. An automobile insurance market is influenced by the number of automobiles owned and the sales of new cars. The amount of fire insurance account for 16% of the general insurance market, that was the second largest general insurance. This market is influenced by the number of houses constructed. A new general insurance account for 12% of the general insurance.

In recent years, the number of earthquake insurance applicants has been on the rise. Japanese earthquake insurance was born in 1966 after the 1964 Niigata earhquake. It was not popular to Japanese people at first. However, it became popular by several earthquake, the Great Hanshin earthquake in 1995 and Tohoku earthquake in 2011. The 60% of fire insurance subscribers sign the policy of earthquake insurance nowadays. In Japan, people cannot apply earthquake insurance without fire insurance.

On the other hand, it is said that the number of automobile insurance applicants will decrease because the domestic sales of new automobiles will remain flat or decrease. In addition, the 50% of Japanese 10's and 20's people do not want to buy a car according to the reporot of Japan Automobile Manufacturers Association in 2017. They interested in car rental and car sharing because they want to avoid a operation and maintenance cost associated with car.

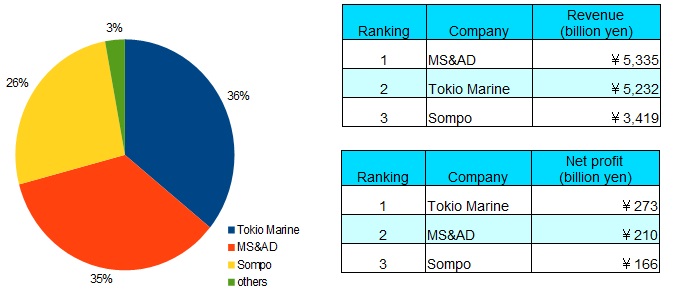

There were 27 general insurance companies in Japan until 1996, but they accelerate M&A from 2000 to improve management efficiency. Nowadays, three general insurance companies called Mega-sonpo account for about 90% of domestic market. The three general insurance companies are Tokio Marine Holdings, MS&AD Insurance Group Holdings and Sompo Holdings.

Tokio Marine Holdings has Tokio Marine & Nichido Fire Insurance Co., Nisshin Fire & Marine Insurance Co., E.design Insurance Co. and Tokio Marine & Nichido Life Insurance Co.. Tokio Marine & Nichido Fire Insurance is the largest general insurance company in Japan. Its sales(net premiums written) is about 3.7 trillion yen in 2017. Tokio Marine Holdings is a member of Mitsubishi group though it is not named the prefix of "Mitsubishi".

MS&AD Insurance Group Holdings was born by business integration of "M"itsui "S"umitomo Insurance and "A"ioi Nissay "D"owa Insurance. It is proactive in the insurance telematics and improving bussiness efficiency by AI and RPA(Robotic Process Automation). MS&AD Insurance Group Holdings is a member of both Mitsui group and Sumitomo group.

By the way, Japanese general insurance compnaies accelerate expanding overseas by M&A. Tokio Marine bought HCC insurance in USA and medical insurance of AIG. MS&AD also bought amlin in UK and First Capital in singapore. Sompo Holdings was behind them, but it bought Endurance Specialty Holdings of UK in 2017.

Tokio Marine Holdings, MS&AD Insurance Group Holdings and Sompo Holdings are listed on the Tokyo Stock Exchange. Foreign investors can invest in Tokio Marine and MS&AD on NYSE by ADR(American Depositary Receipt). In addition, they can do them through many ETFs, MAXIS Nikkei 225 ETF(NKY), iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more.

Construction Market

Construction Market Telecommunications Market

Telecommunications Market Automobile Market

Automobile Market Real-estate Market

Real-estate Market