Market share of life-insurance

The market of medical and cancer ins increase!

- Japanese life insurance market size is the second largest size in the world.

- Medical insurance and cancer insurance are increasing though the market is shriking.

- Japanese life-insurance companies are proactive in overseas expansion.

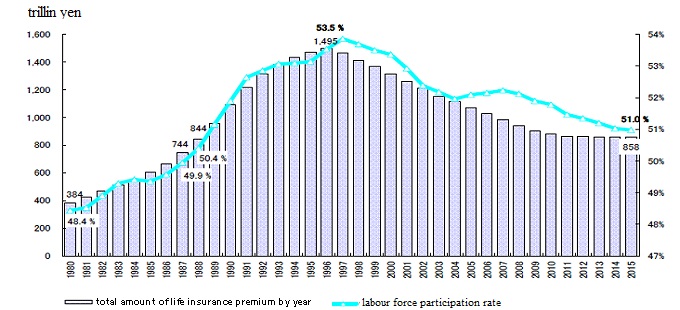

The market size of life-insurance in Japan is about 860 trillion yen(about 8.6 trillion dollar) based on outstanding contract amount according to the report of in 2016. That is about 33 trillion yen based on the total amount of life insurance premium by year. This market size is the second largest size in the world, marked the second only to USA. Rates of subscriptions to life insurance is about 90% in Japan.

The total premium income in 2016 was 11.4% decrease from the previous year because of negative interest rates by BOJ(Bank of Japan). Many life insurance companies stopped some cash-value life insurance because they cannnot keep an investment return. The total premium income will decrease as long as BOJ keep negative interest rates.

The market size of life insurance in 1996 is about 1,495 trillion yen, it recorded the largest ever in Japan. This market shrinked about 640 trillion yen for 20 years. A life insurance became popular among ordinary people from 1960, especially death insurance was popular by the first half of 1990s.

The market of medical insurance and cancer insurance increased from the late 1990s instead of death insurance. A medical insurance is against desease and serious injury, a cancer insurance is against only cancer. These insurance account for 37% of the number of new contract in 2015. Recently, many life insurers release new medical insurance for people who have chronic disease or anamnesis.

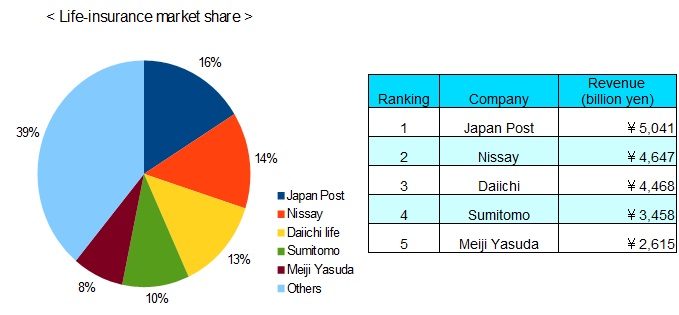

About market share of life insurance in Japan, Japan Post Insurance Co is the largest life insurer in Japan. It was state-owned enterprise, but it was committed a government agency to a private entity in 2005. It is listed on the Tokyo Stock Exchange in 2015. Nippon Life Insurance Company called Nissay is the largest life insurer among private enterprises. Nissay was replaced by Dai-ichi Life Insurance Company and fell to the second placein 2015, but replaced Dai-ichi Life again in 2016. The two companies are in hot competition for the largest life insurer.

Sumitomo Life has third share, Meiji Yasuda Life has the fouth share of life insurance in Japan. In addition, foreign‐affiliated companies also have certain levels of market share and presence in Japan, MetLife, Aflac(American Family Life Assurance Company) and Gibraltar Life Insurance. Sony Life which is a subsidiary of SONY has been steadily increasing its sales. Its sales rise above one trillion yen in 2016.

By the way, Japanese life-insurance market shrinks for 16 years in a row though the world life-insurance market increase 170% for 10 years. Japanese life-insurance companies are proactive in overseas expansion. They do it through M&A such as Nissay bought MILC in Australia, Dai-ichi Life bought Protective in USA, Meiji-Yasuda bought StanCorp in USA, Sumitomo Life bought Symetra in USA.

Japan Post Insurance and Dai-ichi Life are listed on the Tokyo Stock Exchange, but Nissay, Sumitomo Life and Meiji Yasuda Life are not listed. In addition, they can do them through many ETFs, MAXIS Nikkei 225 ETF(NKY), iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more.

Construction Market

Construction Market Telecommunications Market

Telecommunications Market Automobile Market

Automobile Market Real-estate Market

Real-estate Market