Market share of OA equipment

The demand of copying machines and printers will decrease, but!?

- The market size of office automation equipment in Japan is about 8.3 trllion yen.

- Ricoh has the top share of copying machine and multi-function printer market in the world.

- Japanese office automation equipment manufacturers are proactive in business alliances and M&A.

The market size of office automation equipment is about 8.3 trllion yen(about 83 billion dollars) according to the total sales of 11 Japanese office automation equipment manufacturers in Japan. Office automation equipments for export are about 6.7 trillion yen and the other is for domestic market according to the report of Japan Business Machine and Information System Industries Association in 2016.

The office automation equipment market was growing until 2007, but it shrinked from 2007 to 2012 because of the financial crisis. The sales and profit of Japanese manufacturers decreased by the rise in the value of the yen. This market is increasing slightly or leveling off after 2012.

In the medium to long term, the demand of copying machines and printers will continue to decrease because of paperless work by smartphone and tablet computer. This market faces to be in severe situation in the future. However, it is said that there is still room for growth in multi-function printer for office. Japanese manufacturers sell it with managed print service. Office workers can not only print out and fax the data by own PC but also share the data with smartphone and tablet computer through printer by this service.

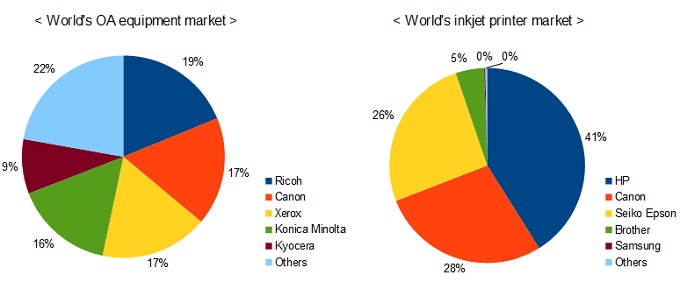

About the share of office automation equipments, Ricoh has the top share of copying machine and multi-function printer market in the world according to the report of IDC in USA. Canon has the second share, Fuji Xerox has the third share, Konica Minolta has the fourth share of this market. Ricoh also has the top share of the domestic market, but Fuji Xerox has the second share.

On the other hand, HP(Hewlett-Packard) accounts for about 40% of the ink-jet printer market in the world. HP, Canon and Seiko Epson occupy this market. Canon and Seiko Epson account for about 90% of domestic ink-jet printer market. HP has a few share of Japanese ink-jet printer market.

Ricoh is one of the large office automation equipment manufacturer in Japan. It sells not only office automation equipments but also on-vehicle camera, IC for power supply, digicam and watch for general consumers. It operates over 200 overseas offices all over the world. It is aiming to expand other market because office automation equipment market has been slack.

Canon is the largest office automation equipment manufacturer in Japan. It is also known as the largest digicam manufacturer in the world. It is enthusiastic about advanced R&D, the number of its patent registrations in the USA is largest among Japanese companies.

FUJIFILM started as a photo film manufacturer, and it established joint company Fuji Xerox with xerox in 1962. FUJIFILM moved in on the office automation equipment market through Fuji Xerox. KONICA MINOLTA's predecessor is KONICA which is also a photo film manufacturer. KONICA merged MINOLTA which sold cameras and copying machine in 2003, and changed its name to KONICA MINOLTA. Seiko Epson (or simply Epson) was established by Hisao Ymazaki who worked Seiko Holdings which is famous as watch. Seiko Epson is not subsidiary of Seiko Holdings, but is invested a little money by Seiko Holdings.

By the way, Japanese office automation equipment manufacturers are proactive in business alliances and M&A as well as manufacturers of other industy in Japan. Canon was associated with HP in 2009, and bought Océ N.V. which is one of the large European printing and copying machine manufacturer in 2010. Fuji Xerox bought Upstream Print Solutions in Australia, KONICA MINOLTA also bought Ergo Asia Pty in Australia.

Canon, Ricoh, KONICA MINOLTA and Seiko Epson are listed on the Tokyo Stock Exchange. Foreign investors can invest in them on NYSE by ADR(American Depositary Receipt). In addition, they can do them through many ETFs, MAXIS Nikkei 225 ETF(NKY), iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more.

Motorcycle Market

Motorcycle Market Robot Market

Robot Market Digicam Market

Digicam Market Hotel Market

Hotel Market