Market share of construction machine

The four major manufacturers pull Japanese market!

- The market size of construction machine in Japan is about 6.3 trllion yen.

- Komatsu is the largest construction machine manufacturer in Japan, and ranks second in the world.

- Japanese construction machine manufacturers are proactive in developing machines with IT.

The market size of construction machine in Japan is about 6.3 trllion yen(about 63 billion dollars) according to the total sales of 27 construction machine manufacturers in Japan. Construction machines for export are about four trillion yen and the other is for domestic market according to the report of Japan Construction Equipment Manufacturers Association in 2016. Construction machines contains hydraulic excavator, dump truck, forklift, tractor, crane truck and more. The shipment value of hydraulic excavator account for 36% of the Japanese construction machine market.

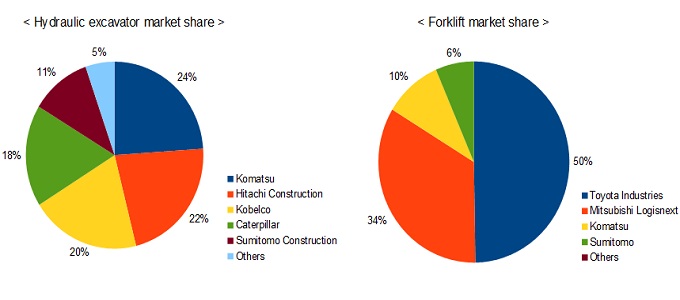

About the share of hydraulic excavator, Komatsu has the top share of this market in Japan. Hitachi Construction Machinery Co. has the second share, Kobelco Construction Machinery Co. which is a subsidiary company of Kobe Steel Ltd. has the third share of this market. About the share of forklift, Toyota Industries Co. dominates this market. Komatsu has the only fourth share of this market.

The Japanese construction machine market was continuously growing until 2007. However, the financial crisis of 2007-2008 stopped its growing because the new privately-owned housing units started plunge in Europe and USA after the financial crisis. In addition, the demand of infrastructure in emerging companies shrinked after crisis.

This market started to recover around 2010 because of economic recovery in the world. In Japan, there was the demand for reconstruction due to Tohoku earthquake and tsunami in 2011. It is said that the demand for reconstruction is from 12 to 18 trillion yen. This market returned to levels before the crisis in 2012, and is increasing year by year.

Most Japanese construction machine manufacturers have already moved forward with foreign expansion. Their sales and profits are influenced by global economic trend. They are also influenced by reource prices trend because construction machines are used for mining industry.

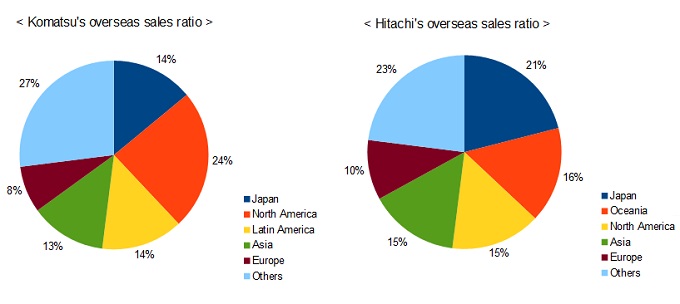

In additon, Japanese construction machine manufacturers are well known for their overseas sales ratio are higher than oher indurty. For example, the sales of Komatsu which is the largest construction machine manufacturer in Japan is about 1.8 trillion yen, about 85% of them from overseas.

There are four major construction machine manufacturers in Japan, Komatsu, Hitachi Construction Machinery, Toyota Industries and Kubota. Komatsu is the largest construction machine manufacturer in Japan, and ranks second in the world, only after the Caterpillar Inc. in USA. Many Japanese associate Japanese construction machine with Komatsu. Its sales is about two trillion yen, the sales of construction machines account for about 90% of its total sales and the other is the sales of industry machines.

The company's name, 'Komatsu' derives from the Komatsu city in Ishikawa Prefecture of Japan. Hideki Matsui who was a professional baseball player comes from Ishikawa Prefecture. In addition, his father worked for the Komatsu. Komatsu put an advertisement in the Yankees Stadium when he joined the New York Yankees in 2003.

Kubota is the second largest construction machine manufacturers in Japan, its sales is about 1.2 trillion yen. It is well known as farm machine manufacturer and the top manufacturer of mini(compact) excavator in the world. Toyota Industries is also the top manufacturer of forklift in the world. It is the company from which Toyota Motor Corporation developed. Hitachi Construction Machinery which is a member of Hitachi group has the second share of hydraulic excavator market in Japan. It is affilliated with Deere & Company which is known for John Deere brand in USA.

By the way, Japanese construction machine manufacturers are proactive in developing machines with IT(ICT) for optimization of construction. It contributes to not only cost reduction but also the efficienty of work. An unskilled operator operates construction machines like skilled operator by its automatic contoller. Komatsu's autonomous (driverless) dump trucks are working in a mine from 2008. In addition, Komatsu decided to its machine installed GPS and communication function called KOMTRAX as the standard item. Nowadays, over 300 thousand machines which are controlled by KOMTRAX system are working all over the world.

Komatsu, Hitachi Construction Machinery, Toyota Industries and Kubota are listed on the Tokyo Stock Exchange. Foreign investors can invest in them on NYSE by ADR(American Depositary Receipt). In addition, they can do them through many ETFs, MAXIS Nikkei 225 ETF(NKY), iShares MSCI Japan ETF(EWJ), Wisdomtree Japan Hedged ETF(DXJ) and more.

Motorcycle Market

Motorcycle Market Robot Market

Robot Market Digicam Market

Digicam Market Hotel Market

Hotel Market